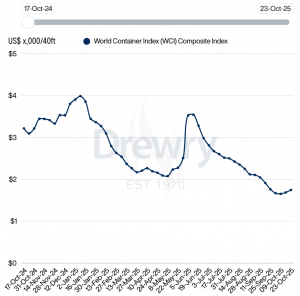

Drewry World Container Index – 23 Oct

For many years, World Container Index has been the go-to, independent, global reference for index-linked contracts. If your organisation is considering index-linked contracts or requires regional visibility/coverage beyond the eight trade lanes provided below.

Drewry’s World Container Index increased 3% to $1,746 per 40ft container this week.

Drewry World Container Index (US$/40ft)

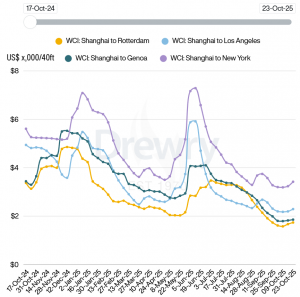

WCI Trade Routes from Shanghai (US$/40ft)

Our detailed assessment for Thursday, 23 Oct 2025

- The Drewry World Container Index (WCI) increased 3% to $1,746 per 40ft container. This is the second straight week of increase, following a prolonged decline over 17 consecutive weeks.

- Spot rates from Shanghai to Los Angeles increased 4% to $2,290 per 40ft container and those to New York rose 6% to $3,420. Drewry expects rates to increase slightly next week due to the GRIs implemented mid-October. Carriers are planning to implement new GRIs on 1 November and 15 November to secure higher prices before the effect of the current rate increases completely fades away.

- Spot rates on the Asia–Europe route recorded further gains this week. The rate from Shanghai to Rotterdam jumped 4% to $1,736 per 40ft container and from Shanghai to Genoa rose 2% to $1,855. Drewry expects a slight increase in rates next week, as carriers come under increasing pressure to lift prices ahead of the annual contract negotiation season. To cap the rate slide in the future, carriers have announced new FAK rates effective 1 November, ranging between $2,600 and $2,700 per 40ft container.

- Drewry’s Container Forecaster expects the supply-demand balance to weaken in the next few quarters, which will cause spot rates to contract.

Spot freight rates by major route

Our assessment across eight major East-West trades